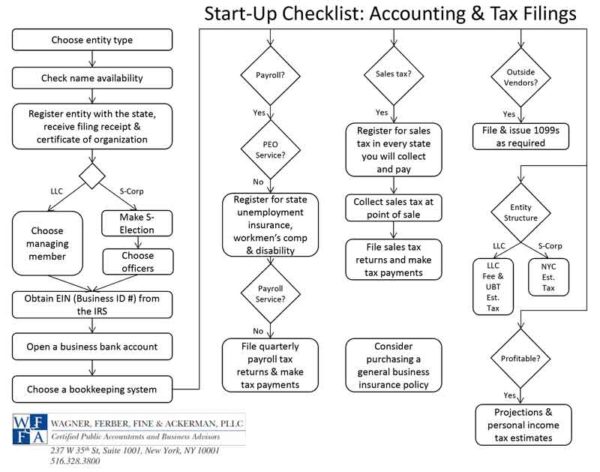

Start-Up Checklist: Accounting & Tax Filings

Starting a new company can involve a lot of filings and registrations that you might not even have known existed, and it can get a little overwhelming. The flow chart will help you make sure you touch all of the bases and nothing falls through the cracks.