Back in January, 2018, we walked through one of the most substantial changes to come out of the new tax law, the 20% QBI Deduction (Section 199A). In November we talked about aggregation and how to handle multiple pass-through entities when calculating the 20% deduction. Most recently we reviewed the safe harbor rules provided by the IRS to help determine if your real estate investment qualifies as QBI. Now, the IRS has provided some additional insight and information into this section of the tax code, including an FAQ and draft forms for the 2019 tax year. Let’s review some of what we already know and dive a little deeper into what the IRS has brought to the table with its latest round of clarifications.

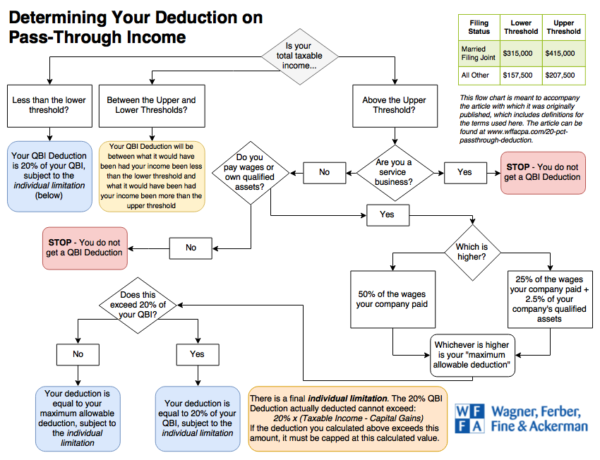

- What is the Qualified Business Income (QBI) Deduction? At the most basic level, it is a deduction, taken on your personal tax return, equal to 20% of the Qualified Business Incomefrom pass-throughs that you report on your personal return. Revisiting our flow chart will provide a quick refresher, or check out this article for a more detailed recap of the QBI Deduction.

- Who can take the QBI Deduction? Individuals, as well as some trusts and estates.

- How do S-Corps and Partnerships handle the deduction? They pass the relevant information through to their owners on Form K-1 so that the owners can either claim the deduction (if an individual) or pass it through again (if another Partnership).

- What type of businesses generate QBI? QBI is generated by a qualified trade or business. All businesses are qualified trades or businesses except for C-Corps, the trade or business of performing services as an employee, and specified service trades or businesses (SSTBs). A list of SSTBs can be found here.

- My taxable income is below the threshold ($315,000 for married filing joint, $157,500 for everyone else), does it matter if my business is an SSTB? No – if your taxable income is below the threshold you are not limited by the SSTB rules.

- Does the QBI deduction reduce other types of tax, such as self-employment tax or net investment income tax? No

- Do I need to adjust my QBI for any other items on my tax return? Yes! QBI must be reduced by other items of gain or deduction related to the business, such as gains from Form 4797 (for the sale of business property), the deductible portion of self-employment tax, self employed-health insurance, and self-employed retirement plan contributions.

- What about insurance premiums paid to >2% shareholders in an S-Corp? Aren’t these already deducted by the S-Corp? While controversial, the IRS’s current stance is that these do need to be deducted from QBI on your personal tax return even though they were already deducted by the S-Corp. This may mean that the S-Corp health insurance is reducing the QBI twice, but this is how the IRS is requiring that it be handled as of now.

- If I am a real estate professional, will my rental real estate qualify for the QBI deduction? The real estate professional rules are unrelated to the QBI rules and have no bearing on whether rental real estate qualifies for QBI.

- How do I determine if my rental real estate qualifies for the QBI deduction? There are three ways of qualifying:

- The activity must rise to the level of a 162 trade or business, i.e. “facts and circumstances”. The taxpayer must be actively involved in the activity with continuity and regularity and the primary purpose for engaging in the activity must be for income or profit.

- Satisfy the requirements of the safe harbor.

- Meet the self-rental exception (i.e. the rental property has common ownership with a qualified trade or business, who is the rental property’s tenant).

- How do QBI income and losses incurred in the same year affect each other? You must net any QBI income and QBI losses (from multiple businesses) together to determine their net QBI for the year. Losses are allocated to income-producing activities pro-rata based in proportion to each activity’s income. If the income and losses total to a net loss, the net loss is carried over to the next tax year and will offset any income incurred in the next year (or be carried forward again). Note – QBI losses from a trade or business do not have to be netted against QBI income from a REIT or PTP.

- Do I have to materially participate in a business to qualify for the deduction? No – if a business qualifies as an eligible trade or business, the QBI flows to all shareholders whether they materially participate in the activity or not.

- I expected to get QBI from a partnership I invested in, but the K-1 did not have any QBI information. What should I do? Reach out to the partnership and request clarification. If the QBI info should have been on your K-1, request that they provide an amended K-1. If the information is not on your K-1, you may not be able to take the deduction, even if you would have otherwise been entitled to it.

- I get guaranteed payments on my K-1. Do this count as QBI? No

- How do I handle losses that are limited by basis, at-risk or pass activity rules? Items not included in taxable income are not considered “qualified” and therefore do not affect QBI. If these items are carried forward and used in a future year, they will affect QBI if they were incurred beginning on January 1, 2018 (when the law went into effect). Any losses incurred prior to the law going in effect will not affect QBI when they are eventually used (so make sure you track this carefully)!

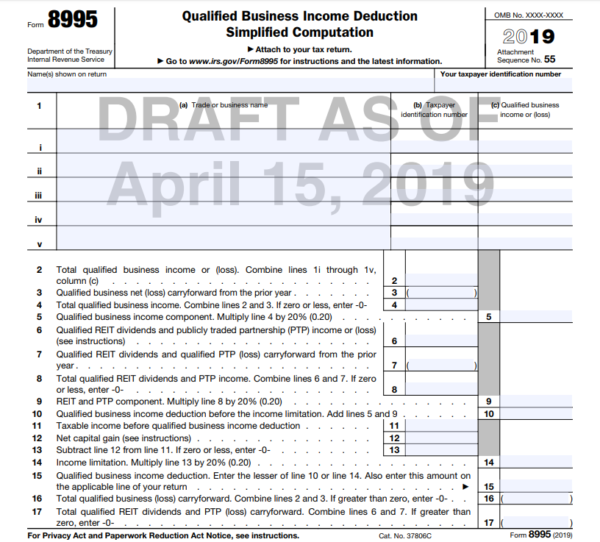

- Is there a form for reporting the QBI deduction in 2018? No, however, the IRS has released draft forms for the 2019 tax year:

- Form 8995 “Qualified Business Income Deduction Simplified Computation”

-

- Form 8995-A “Qualified Business Income Deduction” (which provides much-needed clarity and structure on reporting deductions to QBI, aggregation of entities, phase-in calculations, and PTP income)

The IRS will continue to release additional information and clarifications about this complicated new aspect of the tax code, so check back for further updates.

The topics discussed in this article are complex, and we were not able to cover all of the specific details of this aspect of the tax law in only a few pages. You should always consult your tax advisor about your specific situation and circumstances before making any tax planning decisions.