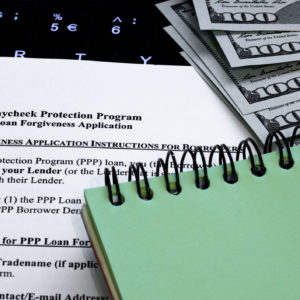

The SBA and Treasury released (yet) another update to the PPP rules, this time focusing on helping the smallest borrowers, those with PPP loans of $50,000 or less.

Who does this apply to?

Any small business who received a PPP loan of $50,000 or less, except for borrowers that together with their affiliates (based on the SBA’s definition of an “affiliate”) received loans totaling $2 million or greater.

What changed for these borrowers?

Two of the ways that PPP Forgiveness can be reduced or limited, the headcount reduction limitation and the salary and wage reduction limitation (explained in this article), have been completely eliminated! This should help small businesses ensure that, as long as they’ve spent their PPP funds on qualified costs, they will be eligible for full forgiveness on their loan.

What other resources should I know about?

This simplified forgiveness application, Form 3508S (and if you’re feeling adventurous, the related instructions).

In conclusion…

This is a good thing for small business owners and should help them by simplifying the forgiveness process and removing limitations that might have reduced their forgiveness. Dreading getting your PPP forgiveness application started? Let us know, we can help walk you through this process.