With all the talk during the pandemic to save money, it is possible to go too far. Included here are some ideas to make sure this does not happen to you. The Social Security Administration recently announced its 2021 cost of living adjustments. More wages will be taxed and retirement checks will go up. The annual details and some interesting Social Security information are outlined here. And if your small business is struggling on how to make ends meet during this challenging time, here are some hints to effectively price your products. All this and some handy every-day tips EVERYONE should know.

Please call if you would like to discuss how this information could impact your situation. If you know someone who can benefit from this newsletter, feel free to send it to them.

Saving Too Much Can Sometimes Be Expensive

When it comes to money topics, you’re always hearing how to save more. But even with the best of intentions, you can run into trouble when you try to save too much. Here are four ways that savings can get in your way and how you can correct them.

Savings that turns into spending. Buying something on sale to save money is still spending. Focus on the amount of money you have to part with, instead of focusing on the great deal. These deals use the human emotion of the fear of losing out, causing you to spend money you did not plan on spending in the first place.

What you can do: Plan your purchases. If something on your list of planned purchases is then on sale, you will truly be saving money. So instead of saving 50% on a new lawn mower, save 100% because you already have one that works just fine.

Savings that turns into hoarding. This could happen if you have a hard time parting with things for fear you might be able to use it in the future. This could be as simple as buying a new set of dishes or a new pair of shoes and hanging on to the old ones just in case. Each time you acquire something new without throwing out the old, your house gets stuffed with items you don’t need.

What you can do: When you need to replace something, try to sell the old item right after bringing in the new item(s). Not only will this keep the clutter out of your home, it will effectively lower the cost of the replacement. And periodically review the contents of your household. Have you used it in the last 12 months? If not, chances are good that you won’t need it in the foreseeable future.

Not replacing things when you should. This savings behavior might actually be costing you money. For example, that old water heater still works, but it could be so inefficient that it is costing a ton in excess electricity or gas. The same could be true with an old car’s maintenance bills or even wearing clothes even though you’ve worn holes in them.

What you can do: Consider replacements as investments. For instance, replacing the old brakes in your car is an investment in your safety. Replacing your worn out shoes is an investment in your comfort. Replacing your toothbrush that is falling apart is an investment in your health.

Risking damages or dangers. It’s great to save money by doing something by yourself, but know your limits. Sure, cutting down that old tree by yourself can save you a ton of money. But the emergency room is full of do-it-yourself savers who lack the experience to do it safely. The same can be true with making financial decisions or even wading through the tax code on your own.

What you can do: Know your limits and ask for help. Sometimes paying a little more is worth it if it means avoiding a potentially dangerous or financially negative situation.

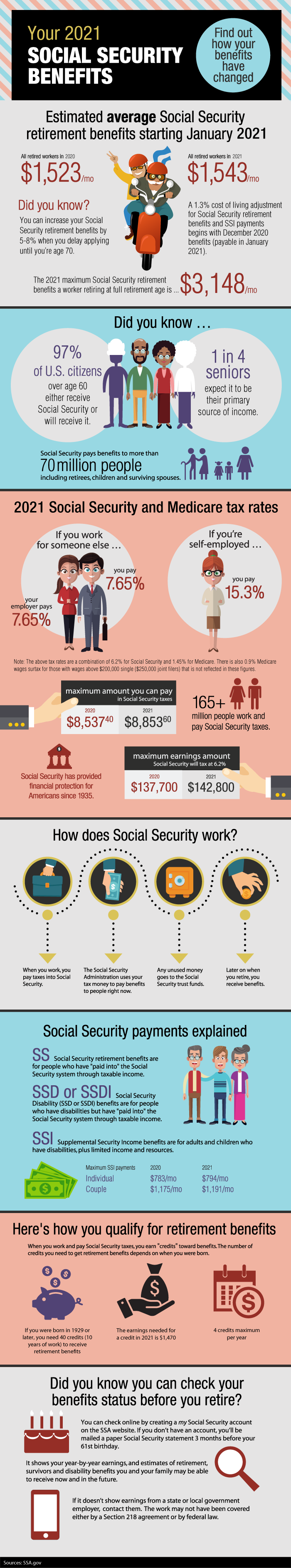

Social Security Benefits Increase in 2021

How to Walk the Tightrope When Raising Prices

Raising prices can be fraught with risk during good economic times. So what happens if you try to raise prices during bad economic times?

As Hamlet would say, “Ah, there’s the rub.” If you raise prices, you risk losing clients to competitors. If you don’t, decreasing revenue or rising costs can capsize your company. So what’s a small business supposed to do?

The Art of Pricing

Raising (and, sometimes, even lowering) prices can be a balancing act. As with any major business decision, pricing should take into account various factors. Here are several to consider.

Analyze costs. First, you need to carefully analyze the costs needed to bring your products or services to market. Such expenses might include raw materials, storage, personnel, advertising, delivery, rent, equipment, taxes and insurance. Failure to cover all these costs in your price will inevitably lead to shrinking profits.

Establish profit margin. Next, it’s important to establish an acceptable profit margin. This is where the art of pricing begins. To find your company’s sweet spot with regards to pricing, consider researching competitors in your region to determine their pricing for comparable products, raising your finger to the wind to discern the business climate and asking your customers about their preferences.

Listen to your customers. Your customers will tell you if you raised prices too high. They’ll either continue to buy your product or seek out a competitor.

Consider incremental price increases. Small, incremental price increases tend to be more palatable to customers than a few large changes. We see this every day in the rising cost of gasoline, utilities and taxes. Many customers can handle incremental inflation…just don’t shock them with a huge increase all at once.

When considering pricing, it’s important to take a long, hard look at both your costs and the quality of your products and services. Customers will generally pay a premium for goods and services that provide greater value. Successful business owners endeavor to increase both the actual quality of their products and the perception of that quality in the minds of customers. Do both well, and a price increase may be in order.

Steer Clear of Money-Making Scams While You’re Stuck at Home

While there are plenty of legitimate opportunities to earn extra cash, the Federal Trade Commission (FTC) says to steer clear from the following money-making scams:

At-Home Medical Billing Businesses. Many medical billing business opportunities are worthless. Their promoters don’t tell the truth about earnings potential and fail to provide key information.

Envelope-Stuffing Schemes. Offers that promise quick and easy income from stuffing envelopes at home virtually never pay off.

Telemarketing Resale Scams. Selling brand-name merchandise from home can be a great way to work at home making some extra money. But fraudsters sometimes call to lure you into a resale proposition. They’re the ones who make the money – and they make it from you.

Work-at-Home Businesses. Many work-at-home opportunities are promoted by scam artists. If you pay in, it’s likely that you will spend more than you can earn.

How to Protect Yourself

- Do your research. Talk to other people and read reviews about the work-from-home opportunity you are considering. Also consider checking out a company with your local consumer protection agency, your state’s Attorney General office or the Better Business Bureau.

- Request the FTC’s one-page disclosure document. Sellers of work-from-home opportunities are required by the FTC to give you a one-page disclosure document that offers key pieces of information about the opportunity. Click here to see what the document looks like.

- Ask follow-up questions. In addition to reviewing the disclosure document, ask the sellers various follow-up questions such as the following: What tasks will you have to perform? Will you be paid a salary or be on commission? What is the basis for the company’s claims about what you can earn? When will you get your first paycheck?

Reporting a Scam

If you have spent time and money on a work-at-home program and now believe it may not be legitimate, contact the company and ask for a refund. If you can’t resolve any disputes with the company, file a complaint with the FTC at ftc.gov/complaint or call 877-FTC-HELP.

Also file a complaint with your state’s Attorney General office or the state where the company is located.

Retirement Savings Tips for Small Business Owners

As an owner of a small business, you’ve proven that you’re a self-starter by operating a successful private enterprise. Of equal importance is applying your skills towards saving for your future. Here are some of the most popular tax-advantaged retirement vehicles for small business owners in 2020 and some tips on saving for retirement.

Options if you’re not currently enrolled in a plan

For small business owners not currently enrolled in a retirement plan, here are three of the most popular retirement account options:

- Simplified Employee Pension (SEP) IRA Account. Contribute as much as 25% of your business’s net profit up to $57,000 for 2020.

- 401(k) Plan. Contribute up to $57,000 of your salary and/or your business’s net profit.

- Savings Incentive Match Plan for Employees (SIMPLE) IRA Account. You can put all your business’s net profit in the plan, up to $13,500 plus an additional $3,000 if you’re 50 or older.

Which plan should you choose? SEP and SIMPLE IRAs are ideal for either sole proprietors or really small businesses (no more than one or two dozen employees). Due to higher administrative costs, 401(k) plans are usually more suited for larger small businesses (more than one or two dozen employees).

Tips to maximize your retirement contributions

For small business owners who are currently enrolled in a retirement plan, here are some suggestions for maximizing your annual contributions into your retirement accounts:

Pay yourself first. Instead of funding your retirement account with whatever is left over after paying your monthly bills, decide at the beginning of each month how much you want to set aside to fund your retirement. Make funding your retirement each month as important as your other bills. Then assume that you pay your retirement bill first. If you run out of money before paying all your bills, decide if there are any expenses that can be pared back for subsequent months so you can meet your monthly retirement savings goal.

List your retirement contributions on your income statement. It is easy to forget about retirement planning when running the day-to-day operations of your business. To keep retirement contributions top-of-mind, record these as a separate line item on your business’s income statement.

Review your tax situation at least twice a year. Tax planning is now more important than ever with the uncertainty caused by the recent pandemic. So review your tax situation at least twice every 12 months to see how to maximize each year’s retirement contributions.

As always, should you have any questions or concerns regarding your tax situation please feel free to call.