Tax day might seem far away, but waiting until year-end to make your tax moves may prove costly to you. Maximizing your tax savings starts with an effective mid-year strategy! Detailed here are some ideas to kick-start your summer tax planning. This issue also includes some unique and free summer travel destinations, an infographic with key IRS audit information, and five steps to help your business set the right salaries for your employees.

Call if you would like to discuss how this information relates to you. If you know someone who can benefit from this newsletter, feel free to send it to them.

Effective Tax Planning Starts Now!

With summertime activities in full swing, tax planning is probably not on the top of your to-do list. But putting it off creates a problem at the end of the year when there’s little time for changes to take effect. If you take the time to plan now, you’ll have six months for your actions to make a difference on your 2019 tax return. Here are some ideas to get you started.

- Know your upcoming tax breaks. Pull out your 2018 tax return and take a look at your income, deductions and credits. Ask yourself whether all these breaks will be available again this year. For example:Any changes to your tax situation will make planning now much more important.

- Are you expecting more income that will bump you to a higher tax rate?

- Will increased income cause a benefit to phase out?

- Will any of your children outgrow a tax credit?

- Make tax-wise investment decisions. Have some loser stocks you were hoping would rebound? If the prospects for revival aren’t great, and you’ve owned them for less than one year (short-term), selling them now before they change to long-term stocks can offset up to $3,000 in ordinary income this year. Conversely, appreciated stocks held longer than one year may be candidates for potential charitable contributions or possible choices to optimize your taxes with proper planning.

- Adjust your retirement plan contributions. Are you still making contributions based on last year’s limits? Maximum savings amounts increase for retirement plans in 2019. You can contribute up to $13,000 to a SIMPLE IRA, up to $19,000 to a 401(k) and up to $6,000 to a traditional or Roth IRA. Remember to add catch-up contributions if you’ll be 50 by the end of December!

- Plan for upcoming college expenses. With the school year around the corner, understanding the various tax breaks for college expenses before you start doling out your cash for post-secondary education will ensure the maximum tax savings. There are two tax credits available, the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit. Plus there are tax benefits for student loan interest and Coverdell Savings accounts. Add 529 college savings plans, and you quickly realize an educational tax strategy is best established early in the year.

- Add some business to your summer vacation. If you own a business, you might be able to deduct some of your travel expenses as a business expense. To qualify, the primary reason for your trip must be business-related. Keep detailed records of where and when you work, plus get receipts for all ordinary and necessary expenses!

Great tax planning is a year-round process, but it’s especially effective at midyear. Making time now not only helps reduce your taxes, it puts you in control of your entire financial situation.

Can’t Miss Stops for Your Summer Road Trip

School is out, the weather is warm, and it’s time to head out on a summer road trip! Tired of the same old locations? Every state has a number of unique destinations for the every day explorer. Here are some free ideas for the creative vacation seeker in all of us:

- The World’s Largest Yard Sale. Stretching 690 miles through six states, the World’s Largest Yard sale includes over 2,000 vendors. Every year at the beginning of August, you can drive for four days (from Addison, Michigan to Gadsden, Alabama) in search of second-hand treasures. Along the route are more than 35 major vendor stops. These stops include groups of at least 25 sellers clustered together. But you can also find sales in individual yards, garages, parking lots or even right on the side of the road.

- The Wave Organ. Located in San Francisco, California, the Wave Organ is a sprawling sculpture that incorporates multiple pipes that enter the ocean at different levels to create musical tones when they’re struck by the waves. The sculpture itself is made of granite and marble from an old cemetery. When planning a visit, shoot to be there during high tide when the organ is at its best.

- Miss Crustacean Hermit Crab Beauty Pageant. Do you have a hermit crab that really likes to flaunt its shell? Then Ocean City, New Jersey is the place for you! Every August, contestants vie for the Coveted Cucumber Rind Cup by showcasing their elaborately decorated hermit crabs. Registering your charming hermit crab is free – just make sure you get there early.

- Carhenge. If you don’t have time to travel across the ocean to see Stonehenge, you’re in luck! Head to Alliance, Nebraska to visit Carhenge instead. Built in 1987 as a replica of the iconic stone circle in England, Carhenge uses vintage cars as building blocks instead of the 25-ton stones used in the original. It’s located in the middle of farmland and includes a walking path with some other, let’s just say, interesting sculptures.

- The Austin bats. Hidden under the Congress Avenue Bridge in Austin, Texas from late March until early fall lives the largest urban colony of Mexican free-tailed bats in the world. At its peak, (sometime in August) the colony has as many as 1.5 million bats! Every night around sunset, onlookers pack the bridge, sidewalks and river below to experience the colony taking flight in search of insects. If you decide to watch from the water, you might want to bring an umbrella – unprepared spectators are known to be hit with guano (AKA bat poop)!

Hitting the road is a great way to spend some time with loved ones this summer. Adding quirky stops that will be remembered for a lifetime make it even better!

What You Need To Know About IRS Audits

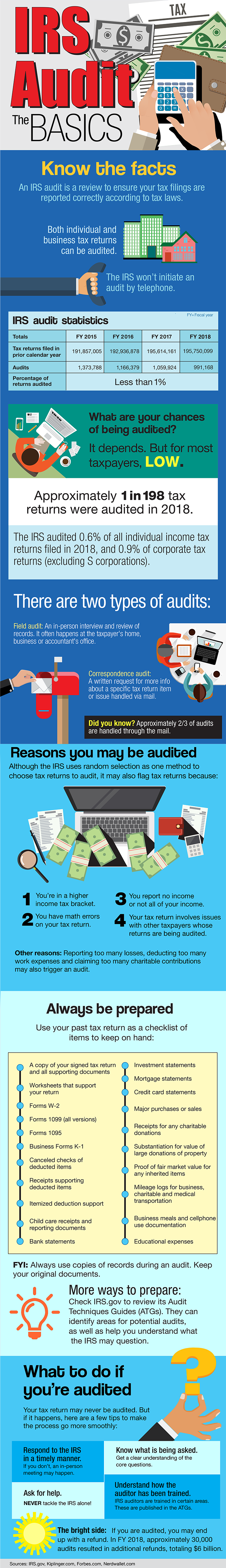

The IRS recently released its 2018 Data Book, including information on its audit activities for the last fiscal year. This details what you need to know regarding your audit risk, how to prepare for and what to expect in an IRS audit.

Know the facts

- An IRS audit is a review to ensure your tax filings are reported correctly according to tax laws.

- Both individual and business tax returns can be audited.

- The IRS won’t initiate an audit by telephone.

IRS Audit Statistics

| Totals | FY 2015 | FY 2016 | FY 2017 | FY 2018 |

| Tax returns filed in prior calendar year | 191,857,005 | 192,936,878 | 195,614,161 | 195,750,099 |

| Audits | 1,373,788 | 1,166,379 | 1,059,924 | 991,168 |

| Percentage of returns audited | Less than 1% | |||

What are your chances of being audited?

It depends. But for most taxpayers, LOW.

Approximately 1 in 198 tax returns were audited in 2018.

The IRS audited 0.6% of all individual income tax returns filed in 2018, and 0.91% of corporation tax returns (excluding S corporations)

There are two types of audits:

- Field audit: An in-person interview and review of records. It often happens at taxpayer’s home, business or accountant’s office.

- Correspondence audit: A written request for more info about a specific tax return item or issue handled via mail.

Did you know? Approximately 2/3 of audits are handled through the mail.

Reasons you may be audited

Although the IRS uses random selection as one method to choose tax returns to audit, it may also flag returns because:

- You’re in a higher income tax bracket.

- You have math errors on your tax return.

- You report no income or not all of your income.

- Your tax return involves issues with other taxpayers whose returns are being audited.

Other reasons: reporting too many losses, deducting too many work expenses and claiming too many charitable contributions may also trigger an audit.

Always be prepared

Use your past tax return as a checklist of items to keep on hand:

- A copy of your signed tax return and all supporting documents

- Worksheets that support your return

- Forms W-2

- Forms 1099 (all versions)

- Forms 1095

- Business Forms K-1

- Canceled checks of deducted items

- Receipts supporting deducted items

- Itemized deduction support

- Child care receipts and reporting documents

- Bank statements

- Investment statements

- Mortgage statements

- Credit card statements

- Major purchases or sales

- Receipts for any charitable donations

- Proof of fair market value for any inherited items

- Mileage logs for business, charitable and medical transportation

- Business meals and cellphone use documentation

- Educational expenses

FYI: Always use copies of records during an audit. Keep your original documents.

More ways to prepare: Check IRS.gov to review its Audit Techniques Guides (ATGs). They are used by IRS examiners and can identify areas for potential audits, as well as help you understand what the IRS may question.

What to do if you’re audited

Your tax return may never be audited. But if it happens, here are a few tips to make the process go more smoothly:

- Respond to the IRS in a timely manner. If you don’t, an in-person meeting may happen.

- Ask for help. NEVER tackle the IRS alone!

- Know what is being asked. Get a clear understanding of the core questions.

- Understand how the auditor has been trained. IRS auditors are trained in certain areas. These are published in the ATGs.

The bright side: If you are audited, you may end up with a refund. In FY 2018, approximately 30,000 audits resulted in refunds, totaling $6 million.

Sources: IRS.gov, Kiplinger.com, Forbes.com, Nerdwallet.com

Make Setting Salaries Easier With These 5 Steps

Whether you are hiring for the first time, filling an open position, or conducting annual performance reviews, finding a salary range that attracts and retains valued employees can be a difficult task. Here are some suggestions to help make the process a bit easier for you and your company:

- Know what your business can afford. Like any business expense, you need to know how it will affect your budget and cash flow. Make a twelve-month profitability and cash forecast and then plug in the high end of the annual salary range you are considering to see if it’s something your business can absorb. After all, the greatest employee in the world can’t help you if you don’t have the money to pay them. Don’t forget to account for increases in benefit costs, especially the escalating cost to provide healthcare. Once you establish a budget, you can allocate your spending plan to your payroll.

- Understand the laws. In general, the federal government sets the minimum requirements (minimum wage of $7.25 per hour, overtime rules and record keeping requirements). States and localities often add their own set of rules. For example, the state of Illinois, Cook County and the city of Chicago all have different minimum wage requirements. If you are located in Chicago you need to adhere to the highest rate. So research all payroll rules that apply to your location at the beginning of the process. When reviewing the rules, don’t forget that different rules often apply depending on the number of employees in your business.

- Review and update job descriptions. Take some time to review key jobs and update them as appropriate. With new positions, note the exact tasks and responsibilities you envision for the role. Then, think about the type of person that will succeed performing these responsibilities. Once you have a clear picture of who you are looking for, you can begin to build a detailed job description and narrow in on a specific salary range.

- Establish value ranges and apply them. Value is key when determining the perfect salary amount. Define the range of value for the position and then apply that valuation to the current person’s performance within the defined pay range. Use websites and recruiters to establish the correct range of pay, then apply experience and employee performance to obtain a potential new salary amount. Remember, size of company, location and competitiveness of the job market are all factors to consider.

- Factor in company benefits. A strong suite of employee benefits is a powerful tool to couple with a competitive salary. Don’t be afraid to communicate their value to prospective and current employees (they help with retention, too!). According to Glassdoor, health and dental insurance are the most important, but flexibility is close behind – over 80 percent of job seekers take flexible hours, vacation time and work-from-home options into consideration before accepting a position.

Finding the right salary can be tricky, but with some preparation and research, you can find the balance that satisfies the needs of your business and your employees.

How To Protect Your Social Security Number

Very few things in life can create a higher degree of stress than having your Social Security Number (SSN) stolen. This is because, unlike other forms of ID, your SSN is virtually permanent. While most instances of SSN theft are outside your control, there are some things that you can do to minimize the risk of this ever happening to you.

- Never carry your card. Place your SSN card in a safe place. That place is never your wallet or purse. Only take the card with you when you need it.

- Know who needs it. As identity theft continues to evolve, there are fewer who really need to know your SSN. Here is that list:

- The government. The federal and state governments use this number to keep track of your earnings for retirement benefits and to ensure you pay proper taxes.

- Your employer. The SSN is used to keep track of your wages and withholdings. It also is used to prove citizenship and to contribute to your Social Security and Medicare accounts.

- Certain financial institutions. Your SSN is used by various financial institutions to prove citizenship, open bank accounts, provide loans, establish other forms of credit, report your credit history or confirm your identity. In no case should you be required to confirm more than the last four digits of your number.

- Challenge all other requests. Many other vendors may ask for your SSN but having it may not be essential. The most common requests come from health care providers and insurance companies, but requests can also come from subscription services when setting up a new account. When asked on a form for your number, leave it blank. If your supplier really needs it, they will ask you for it. This allows you to challenge their request.

- Destroy and distort documents. Shred any documents that have your number listed. When providing copies of your tax return to anyone, distort or cover your SSN. Remember, your number is printed on the top of each page of Form 1040. If the government requests your SSN on a check payment, only place the last four digits on the check, and replace the first five digits with Xs.

- Keep your scammer alert on high. Never give out any part of the number over the phone or via email. Do not even confirm your SSN to someone who happens to read it back to you on the phone. If this happens to you, file a police report and report the theft to the IRS and Federal Trade Commission.

- Proactively check for use. Periodically check your credit reports for potential use of your SSN. If suspicious activity is found, have the credit agencies place a fraud alert on your account. Remember, everyone is entitled to a free credit report once a year. You can obtain yours on the Annual Credit Report website.

Replacing a stolen SSN is not only hard to do, it can create many problems. Your best defense is to stop the theft before it happens.

Basic Customer Retention Questions You Need to Answer

Your business’s ability to retain customers is one of the most important components to sustain growth and profitability. Here are the three retention questions every business owner should be able to answer:

- What percentage of your customers return each year? The first step to understanding retention is to know your customer retention rate. First, take your total customers from the end of a period and subtract the total customers you added during the period. Then, take that number and divide it by the total customers from the start of the same period. The result is your retention rate for that period. That rate by itself doesn’t tell you much, so you need to compare it to the same time period last month and for prior years. A rising rate means you are on the right track; a shrinking rate means you need to make changes. According to the Harvard Business Review, a 5 percent increase in your retention rate increases profits by 25-95 percent! Example: Cut’em Nail Salon starts the year with 700 active clients. They add 300 new customers during the year, and their active client base is 800 at the end of the year. On the surface things look good, right? This increase of 100 clients is over 14 percent! But when you calculate the retention rate, it is 71.4 percent (800 clients minus 300 new clients means 500 of last year’s clients still use Cut’em. 500 divided by 700 equals 71.4 percent). But Cut’em doesn’t know if this is good or bad news, as it only makes sense when comparing it to the last few years’ retention performance.

- What percentage of your revenue comes from returning clients? Core customers almost always contribute the most to your profitability. But how much? To figure out your returning customer revenue percentage, start with a list of revenue by customer for the last 12 months. Identify the returning customers and add up revenue attributed to them. Divide that number by your total revenue. Use this information to balance your spending between new customer acquisition and retaining your core customers. If you are like most businesses, you will realize there is tremendous value in spending more time and effort on retention, even when your business is full! Part 2 Cut’em Nail Salon Example: Assume the nail salon’s total revenue is $1 million and the revenue from the 500 returning clients is $900,000. In this case, the core customers represent 90 percent of the revenue but only 62.5 percent (500 divided by 800) of the customers!

- Do you know who your most valuable customers are? Now identify which customers spend the most and buy the most often. Odds are, many of your top customers have similar characteristics. In the end, your goal should be to keep these customers happy and get more just like them! Part 3 Cut’em Nail Salon Example: In the example above, the average revenue per client is $1,250 per client or over $100 per month ($1 million divided by 800 clients). If the top 20 clients represent $100,000 in revenue or $5,000 per client, you can quickly see how important they are!

Don’t make the mistake of assuming business success comes from constantly adding new customers. Most sustained growth and profitability comes from first understanding marketing activities targeted to keep your current customers. The best place to start is to calculate and understand your base retention numbers.

As always, should you have any questions or concerns regarding your tax situation please feel free to call us.

This month:

July 4: Independence Day

This publication provides summary information regarding the subject matter at time of publishing. Please call with any questions on how this information may impact your situation. This material may not be published, rewritten or redistributed without permission, except as noted here. This publication includes, or may include, links to third party internet web sites controlled and maintained by others. When accessing these links the user leaves this newsletter. These links are included solely for the convenience of users and their presence does not constitute any endorsement of the Websites linked or referred to nor does Wagner Ferber Fine and Ackerman PLLC have any control over, or responsibility for, the content of any such Websites. All rights reserved.