The IRS recently announced that it has selected four collection agencies to provide collections services for certain tax cases beginning next spring. The private tax collectors will be assigned to taxpayer accounts (with certain accounts excluded):

- that have been removed from active inventory for lack of resources or inability to locate the taxpayer

- for which more than 1/3 of the limitation period has lapsed and no IRS employee has been assigned to collect the debt, or

- for which a receivable has been assigned for collection but more than one year has passed without interaction with the taxpayer

As a taxpayer, there are two important points to note:

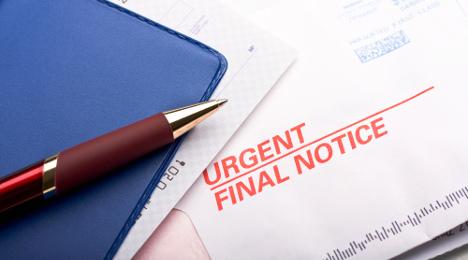

- You will be notified in writing by the IRS that your case has been transferred to a private collection agency

- Taxpayers may request that their case be returned to the IRS

Received a notice or call from the IRS? Not sure if it’s a scam? Let us know, we can work through it together!