Quickbooks Online (“QBO”) does many things well. The improvements Intuit has brought to their cloud-based offering over the past few years have amounted to a near-total overhaul of what was originally an unusable replacement for the classic Quickbooks Desktop. That said, there is still (what I consider to be) a glaring hole in QBO at a basic, fundamental level: the inability to decide for ourselves if a journal entry should affect both accrual and cash basis reports or if it should only affect accrual basis reports. The lack of our ability to choose for ourselves makes it much more difficult to manage the books of a company who need to accurately track both cash basis and accrual basis figures.

A quick note – As I wrote this, I realized that it got pretty long, but don’t worry, there are a lot of pictures, and there’s a reasonably functional workaround at the end, so it’s worth it!

Cash vs Accrual

As a quick review, cash and accrual are two methods of maintaining your books. At a high level:

Cash Basis – Recognize revenue when it is collected and expenses when they are paid (the recording of revenue and expenses follows the cash)

Accrual Basis – Recognize revenue and expenses in the period to which they relate, for example:

- If you get paid up front for a 6-month maintenance contract, recognize the revenue pro-rata over the course of the 6 months

- If you pay your insurance bill for the whole year in advance, recognize the expense pro-rata over the course of the year

- If you pay an attendance fee today for a trade show taking place next year, recognize the expense in the month that the trade show actually takes place

Which accounting method should I use for my company’s books?

The short answer: it depends.

Cash basis accounting is undoubtedly easier and less time consuming to maintain, and for many small companies, it is sufficient. Small companies often file their tax return using the cash basis, so if the company’s management does not care to see accrual basis reports, the cash basis is probably enough.

The accrual basis, while more difficult to maintain, can paint a much more accurate picture of your company’s performance and health. As a basic example:

- You start an IT company that will provide IT services under annual maintenance contracts

- You bring on your first customer, who agrees to a $120,000 annual contract covering all of 2019

- The customer pays you on December 29, 2018

- Your only expense is your monthly hosting costs of $2,000, which you will pay on the 1st of each month starting in 2019

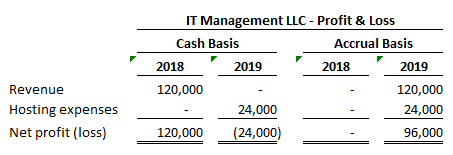

On the cash basis, your Profit & Loss (“P&L”) would show a $120,000 profit in 2018 (because you collected the full fee on 12/29/18) and a $24,000 loss for 2019 (because you had no additional collections, but paid your hosting costs of $2,000 per month). This is not an accurate representation of your company’s performance.

If, instead, you decided to keep your books on an accrual basis, your Profit & Loss statements for 2018 and 2019 would look very different. Instead of recognizing the $120,000 of income in December of 2018, you should show it as Deferred Income (a liability) in 2018, and would recognize 1/12 of this income in each month of 2019. This is a much more accurate representation of the actual contract, which didn’t even kick in until January 2019. This way you recognize your income ($10,000 per month) and your hosting costs in each month of 2019, showing a monthly profit each month of $8,000 ($10,000 of income minus $2,000 of expenses), for a total profit in 2018 of $0 and a total profit in 2019 of $96,000.

Okay, I’m following, but where is the hole in QBO?

The hole in QBO shows up for companies that want to keep their books on both the cash and accrual basis. This may sound farfetched, but it’s actually pretty common. The most frequently cited reason for wanting to use both is that management wants the accuracy of accrual basis reporting but the simplicity and flexibility of filing the company’s tax return on the cash basis.

Is this a reasonable ask?

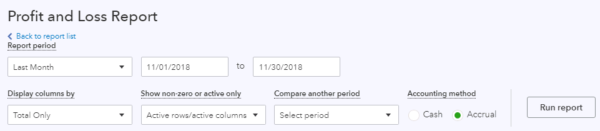

I would argue that yes, it is. Just about every report in QBO gives you the option to toggle between Cash and Accrual basis, so they clearly understand the importance of this feature:

Wait, they already offer this? What are you complaining about?

The hole I’m referring to is one very specific issue that, as an accountant, comes up a lot: In QBO, all journal entries affect both cash and accrual basis reports, even if the journal entry doesn’t affect cash.

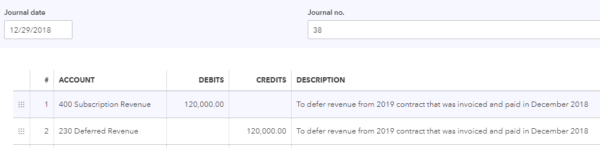

In our earlier example, we collected $120,000 on 12/29/18, which QBO correctly reflects as $120,000 on cash basis reports. However, when you make the following entry to defer the revenue to 2019 (note that the entry does not change any cash accounts, it only adjusts revenue and deferred revenue), both the accrual basis and cash basis reports will now show 2018 sales of $0. This is incorrect! The $120,000 of cash was still collected and is still cash basis revenue in December of 2018. QBO should be flexible enough to allow the user to reflect that this entry does not affect cash (after all, we are required to input an account “type” for every account in our books), and should therefore leave the cash basis revenue for 2018 as $120,000 while decreasing the accrual basis revenue for 2018 to $0.

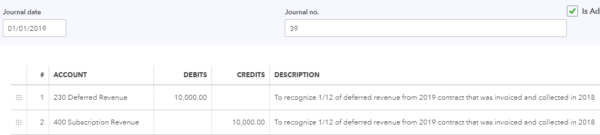

To further illustrate, you now make the following entry to record the January 2019 revenue (which, if done correctly, would only affect accrual basis revenue and would leave cash basis revenue unchanged, as no cash has been collected in 2019).

Given that this entry does not affect any cash accounts, you would expect that our January 2019 Profit and Loss statement would show $10,000 of revenue on the accrual basis and $0 of revenue on the cash basis, however, this is not the case.

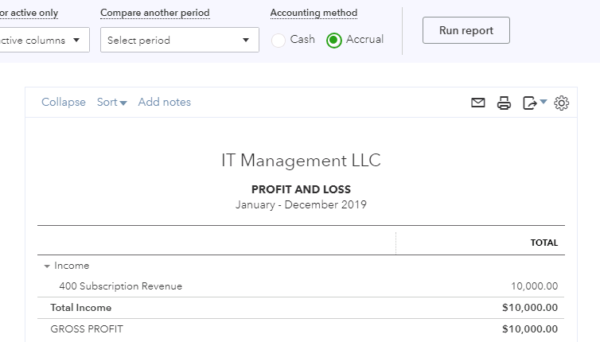

Our accrual basis P&L correctly shows $10,000 of revenue:

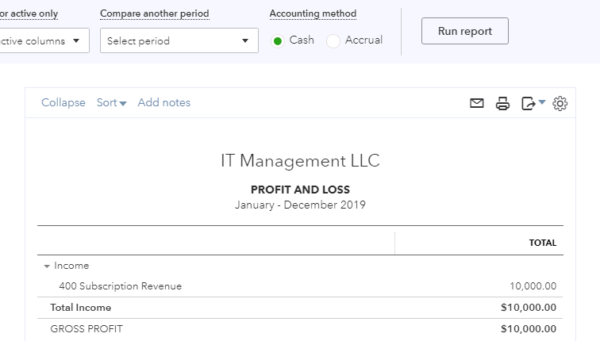

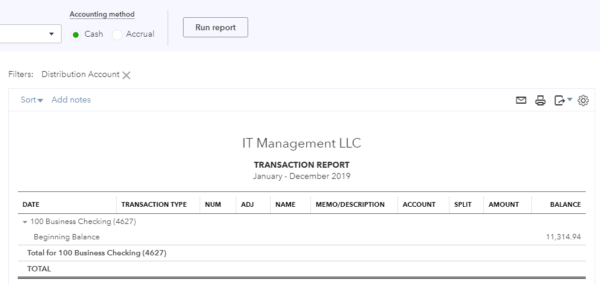

But our cash basis reports show this income as well, despite the fact that (as shown below in the transaction report for the company’s only bank account) no cash has been collected in 2019.

That was long-winded, but I hope I’ve made my point. It doesn’t really make sense that a journal entry that does not affect cash would affect a cash basis report. That said, there can be exceptions to this rule. For example, cash basis taxpayers are still required to capitalize and depreciate fixed assets, and recording depreciation does not affect cash, but should affect cash basis reports. So…

It seems unreasonable to ask QBO to account for every edge-case exception…

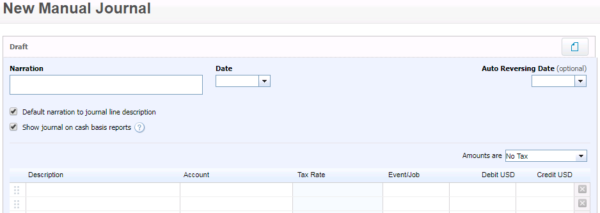

That’s probably true, but why not take an even simpler route and use the age-old method of copying from your competitor. There are things QBO does better than Xero, especially when it comes to using the software as an accountant as opposed to as a business owner, but this is one area where QBO would be well-served to take a page out of Xero’s playbook. Xero includes a checkbox when creating a journal entry that lets you, the user, decide if you want to “Show journal on cash basis reports”.

Intuit, don’t we deserve this flexibility? Don’t we need it to effectively maintain our books?

You may be right, but for now, we’re stuck without this option. So, what do we do?

There are two different routes I’ve been taking:

- Keep accrual basis books in QBO and do a year-end accrual-to-cash basis conversion outside of QBO (read: in Excel) in order to get the books ready to prepare the tax return. This becomes an issue, however, if you have to track your cash-basis revenue more frequently than just at year-end, such as for sales tax filings or for mid-year tax planning

- Use a hacky, duct-tape-esque collection of existing QBO tools in ways that they were not intended to be used in order to record deferred revenue in such a way that both accrual and cash basis reports are correct. I’ll explain…

A hacky, duct-taped workaround:

Here’s the scenario:

- IT Management invoiced its client, XYZ Co, for $120,000 on December 15, 2018 and collected the full amount on December 29, 2018 for a 12-month IT maintenance contract that runs for all of 2019

- IT Management uses QBO to send and manage invoices and collect payments (so breaking this up into 12 invoices to be sent each month in 2019 is not an option)

- IT Management is audited annually by its biggest investor, so they cannot go back and delete the 2018 invoice after it has been collected and recreate them in 2019 because they must maintain an unaltered audit trail

Here’s the workaround (this assumes you already know your way around QBO, if this is gibberish to you, give us a call, we can help!):

- Send the $120,000 invoice to XYZ Co on 12/15/18 (just like you normally would)

- Record the $120,000 payment on 12/29/18 (also as usual)

- Create a new customer in QBO called “Deferred Revenue” (you’ll only have to create this new customer the very first time you use this deferred revenue method)

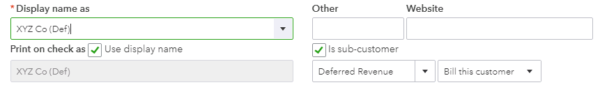

- Create a new sub-customer under Deferred Revenue called “XYZ Co (Def)” and set it to “Bill this customer” – the (Def) is added so that it is easy to pick this out when selecting a customer from a dropdown list in QBO, but you can use any indication, such as an *, if you’d prefer. You should create a new sub-customer for each customer on which you defer revenue

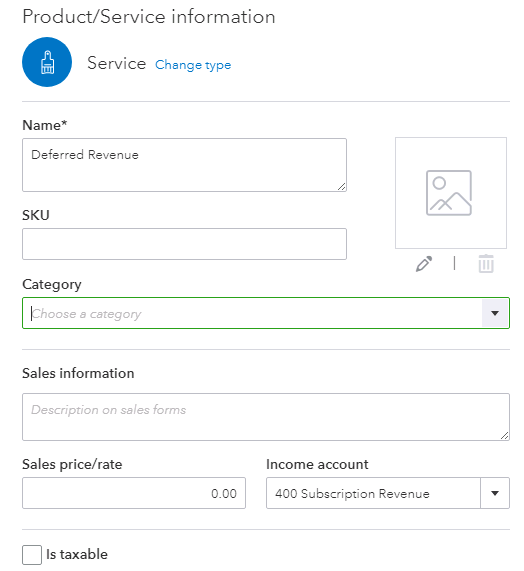

- Create a Service in QBO called “Deferred Revenue” and set the income account to your main revenue/sales account

- Record a credit memo on 12/29/18 for the new Deferred Revenue sub-customer and Service you just created. The amount should be for the full contract amount, $120,000. I like to use the same number as the original invoice + “DR” (for “defer revenue”) for the credit memo’s number so that is easy to tell which credit memos relate to which invoices

Credit memos in QBO only affect accrual basis reports. Once this credit memo is recorded, you’ve successfully deferred the $120,000 of revenue from 2018 to 2019 for accrual basis reports but left it in 2018 (where it belongs) on cash basis reports! Now you can start recognizing the monthly revenue in 2019 ($10,000/month).

- Create an invoice on 1/1/19 using the same Deferred Revenue sub-customer and Service we used for the credit memo. The amount of the invoice should be $10,000, and I’d recommend putting a description that makes it clear at a glance which contract this revenue recognition is related to. I like to use the same number as the invoice + “RR” (for “recognize revenue”) so that it is clear which credit memo and original invoice these revenue recognition invoices relate to. If it is being recognized over many months, you can use “0139RR-1” for the first month, “-2” for the next month, etc.

- Set the invoice to recur monthly over the life of the contract

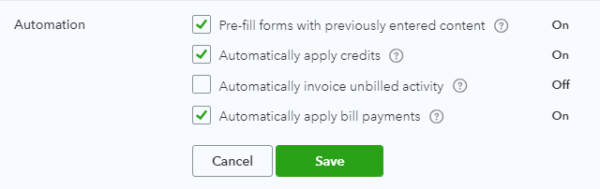

- Set your company settings (in the Advanced > Automation section) to Automatically apply credits. Now, since the credit memo and the monthly invoices are set to the same sub-customer, when each monthly invoice is automatically created the balance on the credit memo will automatically be applied to the invoice. Assuming all is done correctly, after the 12 months of the contract have passed and the 12 invoices have been created, the remaining balance on the credit memo should be $0

That’s it, you should now be accurately deferring revenue for accrual basis purposes but recognizing revenue when collected for cash basis purposes!

What’s the catch with using this method?

- It creates additional work for each contract being deferred

- It forces you to include the Deferred Revenue balance (a credit balance) in with your A/R balance (because credit memos in QBO can only credit A/R, not another account, and QBO doesn’t let you have multiple A/R accounts). This causes your A/R balance on your balance sheet to be wrong. You’ll have to go to your A/R Aging report to get an accurate representation of what your customers owe you. In our example, our A/R balance in January of 2019 should be $0 since we have only issued once invoice and it’s been fully collected. However, because QBO forces our credit memo and our January invoice to be posted to A/R (instead of a separate Deferred Revenue account), our A/R balance will be negative $110,000. This amount should actually be showing up as a credit balance in an Other Current Liability account called Deferred Revenue, so you’ll have to refer to your A/R Aging report to get an accurate breakdown

If you can live with the additional accounting work and the need to go to your A/R Aging report for an accurate breakdown of your A/R and Deferred Revenue, then this method should work for you. But wouldn’t it be nice if QBO had a checkbox on their journal entry screen to let us decide if the entry should affect cash basis reports or not? If this is an issue that you are unwilling or unable to work around, you can also check out Xero as an alternative to QBO.

A final note –

There was a lot going on in this post, so if you made it to the end, mazel tov! If you’re a small business owner and are feeling overwhelmed in the face of issues like this, let us know! We can help you make sense of your books, fine-tune and improve your reporting, and streamline your tax planning to keep your business running smoothly and efficiently.