September 15

– Filing deadline for 2021 calendar-year S corporation and partnership tax returns on extension

– Due date for 3rd quarter installment of 2022 estimated income tax for individuals, calendar-year corporations and calendar-year trusts & estates

Welcome to the last month of traditional summer vacation! And what better way to lead the final month of summer vacation by outlining ideas to save money while taking that long-deserved break.

This month’s letter includes a review of five ways to take advantage of IRA accounts to reduce your tax burden. All done with plenty of time to implement the ideas before the end of the year.

There is also an article to help avoid the tax penalties built into the hobby tax code that excludes the ability to deduct your expenses.

All this plus lots of tips to improve your credit score!

Please feel free to forward the information to someone who may be interested in a topic and call with any questions you may have.

5 Great Things to Know about IRAs

IRA’s can be a powerful tool to lower taxes all while saving for retirement or other predetermined uses. Here are five fairly unreported things to know about IRA’s.

- A nonworking spouse can have an IRA. If your spouse doesn’t work, you may still be able to open and contribute to an IRA for your spouse, assuming that you work and file a joint tax return. This can be a great way to help reduce your taxable income each year.

- Even children can have IRAs. If your child has earned income, you can open and contribute to an IRA. Just ensure you can document the earnings. While your child can contribute their own earnings, many parents will help keep track of things like babysitting money, then match those earnings in either a traditional or ROTH IRA. Often the ROTH IRA is preferred, because the future earnings could be tax free! Your child’s IRA is managed by an adult until the child is old enough for the account to be transferred to their name.

- You may still contribute to an IRA if you have a 401(k) or similar program at work. As long as you do not exceed the income limits, it is ok to have both an IRA as well as other forms of retirement savings plans. It’s simply important to know your options and plan accordingly.

- Non-deductible contributions may be made. If you exceed IRA income phaseouts, contributions to your IRA may not reduce your taxable income for the year. But you may still want to make after-tax contributions to a non-deductible IRA. Remember, while you are taxed on the contributions to a non-deductible IRA, the earnings can still grow tax-deferred.

- It’s not just for retirement. With traditional IRAs, if you withdraw funds before the age of 59 1/2 you may be subject to income tax AND an early withdrawal penalty. But there are exceptions to this rule. These include withdrawals for a first time home purchase, major medical bills, college costs, birth/adoption and many others. However, it is important to know the rules BEFORE you withdraw the funds.

Tax rules surrounding IRAs are vast and complex. But within the rules are numerous situations that if you know they exist, can help you plan for a more tax-efficient future.

Turning Your Hobby Into a Business

You’ve loved dogs all your life so you decide to start a dog breeding and training business. Turning your hobby into a business can provide tax benefits if you do it right. But it can create a big tax headache if you do it wrong.

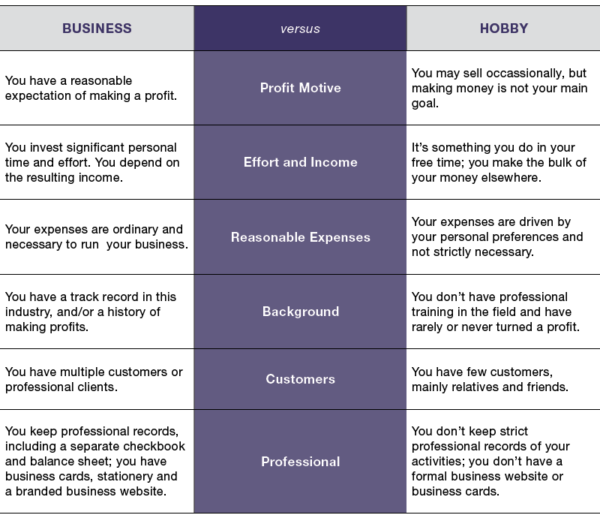

One of the main benefits of turning your hobby into a business is deducting all your qualified business expenses, even if it results in a loss. However, if you don’t properly transition your hobby into a business in the eyes of the IRS, you could be waving a red flag that reads, Audit Me! The agency uses several criteria to distinguish whether an activity is a hobby or a business. So why not make your business activity bullet proof! Here is what you need to know:

The business-versus-hobby test

Honest assessment

As you can see, there is a degree of interpretation involved in reviewing any activity. So, if your dog breeding business (or any other activity) falls under any of the hobby categories on the right side of the chart, consider what you can do to meet the business-like criteria on the left side. The more your activity resembles the left side, the less likely you are to be challenged by the IRS. And to remove any doubt, your best defense is making some money!

Tips to improve your credit score

Credit scores are used to determine interest rates on mortgages, car loans and even the amount you pay for insurance premiums. Because of this, it is a good idea to review ways to improve yours. Here are some ideas:

- Look for errors on your credit report. The place to start is a review of your credit reports. You are entitled to get a free copy of your credit report every 12 months from each credit reporting company: Equifax, Experian and TransUnion. So get a copy of your report and review it for accuracy. Aggressively follow up to correct any errors using the process outlined by each credit reporting company.

- Pay bills on time. The easiest way to improve your credit is to have a string of on-time payments for all bills reported to the credit agencies. This is the most important part of your credit score equation. So while reviewing your credit report, pay special attention to who is reporting your payments and note if any are delayed. Then gather all your monthly bills, identify the due dates, and take advantage of automated tools to ensure the payments are always on time.

- Get credit card utilization as low as possible. The amount of credit you’re using at any given time is called your credit utilization, and is the second-biggest factor in your credit score next to paying on time. For example, if your credit card limit is $5,000 and your balance is $3,000, your credit utilization is 60%. Try to reduce this percentage to no more than 20%. You can do this by spending less, paying off as much of your balance as possible, or increasing your credit limits.

- Sign up for score-boosting programs. A newer way to help improve your credit is to include information on your credit report that normally isn’t reported. Programs like Experian Boost and UltraFICO help you add bills such as rent, utility, and cell phone payments to your credit report, and to analyze how you use your checking, savings or money market accounts. Be aware that these program may ask for access to you bank accounts and could easily work against you if the reporting has a negative impact on your credit if there is a billing problem.

- Avoid requests for new credit. Trying to open a new credit or loan account could lower your score by as much as 10 points. The more inquiries made by creditors who are trying to assess your creditworthiness when trying to open a new account, the more impact it has on your credit score. If you notice a number of vendors are making inquiries, you can always turn off this function with credit agencies. Just remember to turn it back on if you are actively refinancing your mortgage or looking for other credit. While in the long-term your score can be maximized by having a diverse mix of different types of credit accounts, in the short-term adding new accounts will negatively affect your score.

How quickly you can raise your credit score obviously depends on your individual situation, but following these tips will lead to a higher credit score sooner rather than later.

Great Ways to Avoid Vacation Spending Traps

You probably know how easy it is to spend a lot of money while on vacation. The best way to avoid overspending is to know the problem areas and be prepared before you go. Here are five typical vacation spending traps (and tips to avoid them):

- Paying full price. If you plan on going to an amusement park or a fair, most offer pre-sale discounts or set aside days with special rates. Some examples include half-price admission days, opening day, closing day or certain days during the week. In addition to admission discounts, you can often find discounted ride tickets or coupons for food or attractions the day before heading to the attraction.

- Falling for carnival or arcade gimmicks. All you need to do is make one of three basketball shots to win that huge pink gorilla. Or maybe you think you can master that claw machine and snag a new iPhone! Don’t fall for it. Chances are the rim is one foot higher, two inches narrower and the ball might even be egg-shaped. Go ahead and give it a try for fun — just try not to get frustrated if you don’t hit the shot. Carnival and arcade games can be a good time if you have the right mindset. Treat them as entertainment with a spending limit, not a way to easily win a valuable prize.

- Not having a food strategy. Do you really need that whole deep-fried onion? Or that entire bucket of fries? Set aside some money for fun food items, but decide on a dollar limit before arriving at your destination. Also consider preparing some of your own meals to cut down on your overall food budget.

- Impulse buying. Souvenir shops are great, aren’t they? The problem is you (or your kids!) may want to get something at every stop. Identify the shopping areas you would like to visit ahead of time and set a spending limit for both you and your kids.

- Ignoring the weather. All it takes is a pop-up thunderstorm or unexpected heat wave and you can watch the prices on ponchos and bottled water shoot up faster than Old Faithful at Yellowstone National Park. Before you go, check the weather, bring appropriate gear and find out where you can get water.

Vacations are a great way to spend a late summer day and make some memories. Saving some cash with some savvy decisions makes it even better!